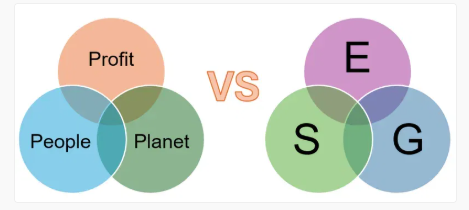

TRIPLE BOTTOM LINE (TBL) OR ESG – WHICH IS THE SUSTAINABILITY MANAGEMENT FRAMEWORK FOR BUSINESSES?

Two popular frameworks for measuring and reporting on a company's sustainability performance are the Triple Bottom Line (TBL) and Environmental, Social, and Governance (ESG).

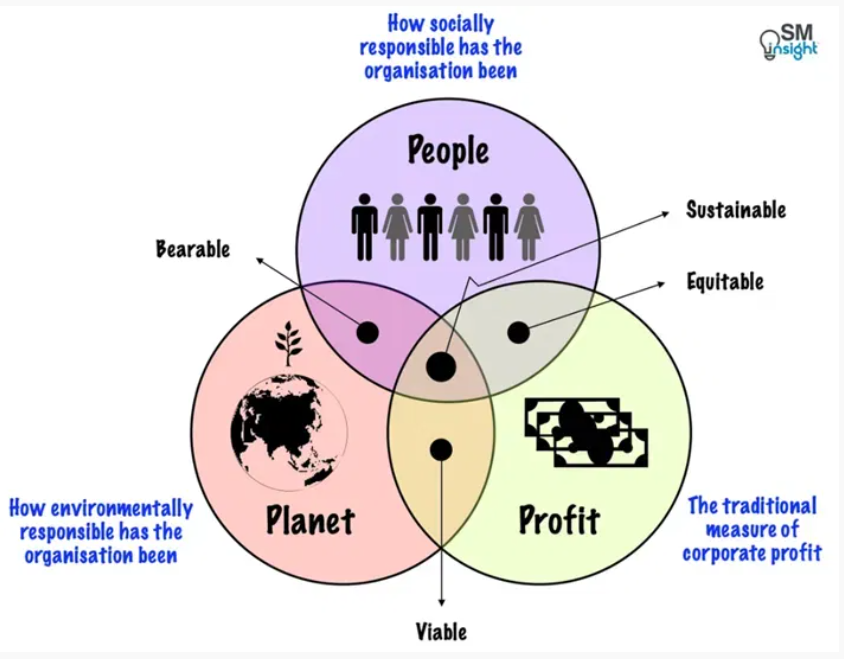

- People: Refers to the company’s social responsibility toward the community, employees, partners, and other stakeholders.

- Planet: Assesses the environmental impact of business operations, including carbon emissions, energy use, waste management, and natural resource conservation.

- Profit: Represents traditional business performance, indicating profitability and growth.

Environmental (E): Climate change, pollution, waste management, energy use, and resource conservation. Social (S): Labor practices, human rights, diversity and inclusion, health and safety, and community engagement. Governance (G): Corporate governance factors such as board structure and independence, business ethics, risk management, and transparency.

2. Purpose and Target Audience

The main purpose of TBL is to promote sustainable development by encouraging companies to balance economic goals with social and environmental responsibilities. It guides strategy formation, sustainable business model design, and stakeholder reporting.ESG, in contrast, focuses on providing investors with information to make more informed decisions. Investors use ESG data to assess non-financial risks and identify companies with sustainable long-term growth potential. ESG has become an essential investment criterion, helping reduce risks and enhance long-term value.- Simple and communicative: Simplifies sustainability, making it accessible to all stakeholders.

- Encourages innovation: Promotes creative solutions balancing profit with social and environmental responsibility.

- Creates multidimensional value: Generates financial, social, and environmental benefits, contributing to holistic sustainable development.

- Lack of standardized metrics: Makes cross-company comparison difficult.

- Risk of greenwashing: Without transparency, TBL can be misused for image-building without real impact.

- Measurement challenges: Some social and environmental impacts are hard to quantify accurately.

- Widely recognized: Accepted globally by investors, offering standardized and detailed evaluation criteria.

- Comprehensive data: Provides in-depth insights into non-financial performance and risk.

- Risk mitigation: Adherence to ESG standards reduces non-financial risks and enhances brand value.

- Financial bias: Despite assessing non-financial factors, ESG is often used mainly for profit-driven investment decisions, potentially overlooking broader social and environmental impacts.

- High cost and complexity: Data collection and reporting can be costly and complex, especially for small and medium enterprises.

- Lack of consistency: Despite multiple ESG standards, uniformity and comparability remain limited.

(Author: Dr. Pham Thai Binh – Deputy Dean Sustainable Finance Institute (SFI) – University of Economics Ho Chi Minh City (UEH))